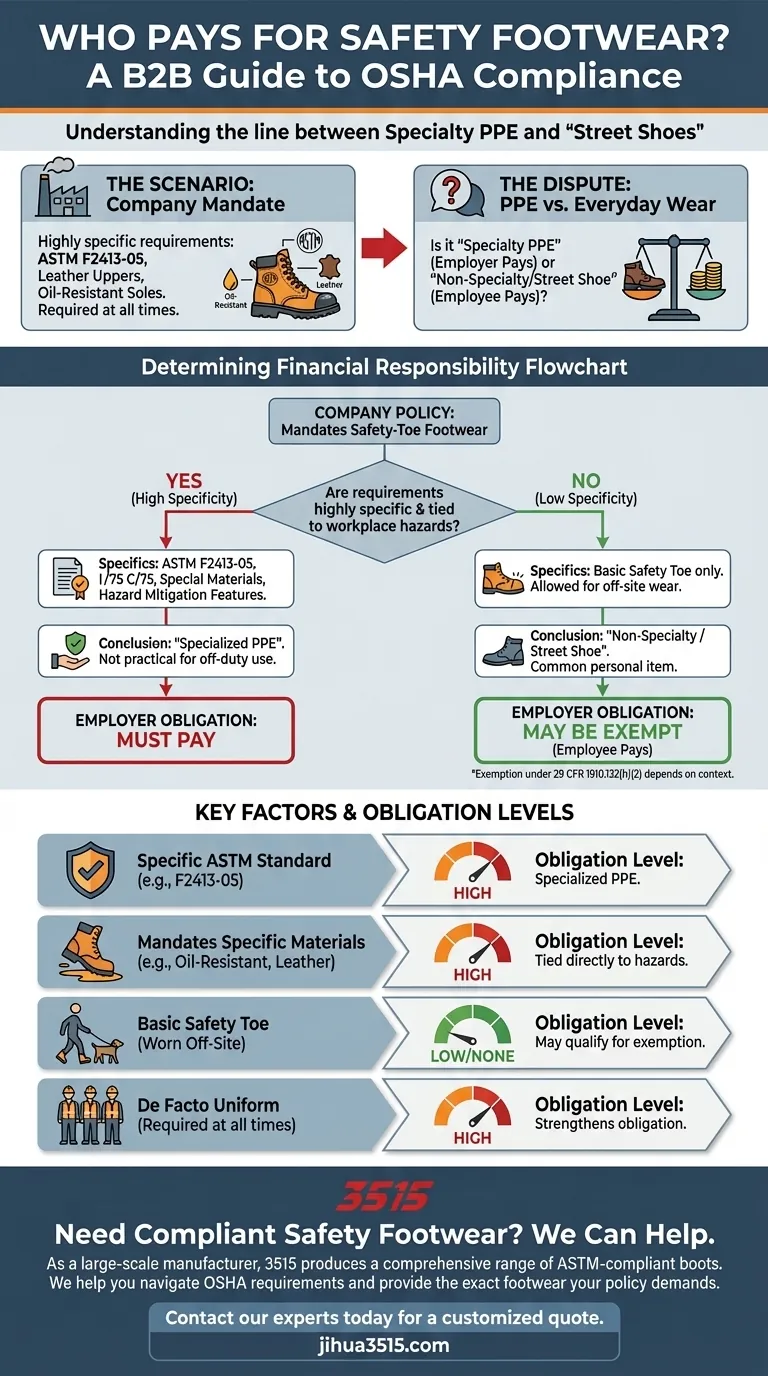

The scenario describes a company policy that requires all employees to wear safety-toe protective footwear meeting highly specific standards, including compliance with ASTM F2413-05, leather uppers, and oil-resistant, non-skid soles. The company mandates this footwear be worn at all times, regardless of immediate hazard exposure, and claims it is exempt from paying for the footwear under OSHA regulation 29 CFR 1910.132(h)(2).

The core issue is whether the company's detailed and specific requirements transform the footwear from general-use "street shoes" into specialized Personal Protective Equipment (PPE). When an employer's specifications are dictated by workplace hazards and render the footwear impractical for ordinary off-duty use, the responsibility for payment typically shifts from the employee to the employer.

The Core of the Dispute: PPE vs. Everyday Footwear

This scenario hinges on the interpretation of an employer's responsibility to pay for required equipment. While OSHA provides some exemptions, they are narrowly defined and depend heavily on context.

The Company's Stated Policy

The company has established a universal mandate for all employees to wear safety-toe footwear. This is not a suggestion but a condition of employment.

The requirements go beyond a simple "steel-toe" rule. They dictate the specific ASTM standard, impact and compression ratings, sole characteristics, and even upper material.

The Claimed Exemption: 29 CFR 1910.132(h)(2)

This OSHA standard contains an important exception. Employers are generally not required to pay for non-specialty safety-toe protective footwear if the employee is permitted to wear it off the job site.

The intent of this rule is to cover sturdy work shoes that an employee might reasonably own for personal use, which also happen to provide a basic level of protection.

Why This Specific Policy is Problematic

The company's position is weakened by the sheer specificity of its requirements. Mandating features like oil-resistant soles and specific ASTM compliance ratings ties the footwear directly to the mitigation of known workplace hazards.

This level of detail makes a strong case that the footwear is not ordinary, all-purpose equipment but is instead specialized PPE necessary for the job.

Deconstructing the "Specialty" Footwear Argument

The distinction between "specialty" and "non-specialty" is critical. Several factors in this scenario push the required footwear firmly into the "specialty" category, creating a payment obligation for the employer.

The Impact of ASTM F2413-05 Compliance

Requiring footwear to meet a specific technical standard like ASTM F2413-05 with defined impact (I/75) and compression (C/75) ratings is a hallmark of true PPE.

These are not arbitrary features; they are performance criteria designed to protect against significant, identified workplace risks like falling objects or crushing forces.

The Role of Specific Material Requirements

The mandate for leather uppers and oil-resistant, non-skid soles is similarly revealing. These features are selected to protect against chemical splashes, slips, and falls—all common industrial hazards.

Such requirements move the footwear away from something an employee might choose for personal use and toward a tool designed for the work environment.

Understanding the Employer's Payment Obligation

The fundamental principle of OSHA's PPE standard is that the employer must assess the workplace for hazards and provide the necessary protective equipment to employees at no cost.

When the Employer is Required to Pay

If a piece of equipment is required for an employee to safely perform their job, the employer must pay for it. This includes equipment needed to comply with any OSHA standard.

The only exceptions are for a few specific items, including the "non-specialty" safety-toe footwear mentioned previously.

The "Street Shoe" Exception Explained

The exemption for safety-toe shoes exists because many durable work boots that people own personally already have this feature. If an employer's only requirement is a basic safety toe and the shoes can be worn home, the employer may not have to pay.

However, this exception breaks down as soon as the employer's needs become more specific than what can be found in ordinary off-the-shelf footwear.

Common Pitfalls in Footwear Policies

Many companies misinterpret the footwear payment exemption, leading to compliance issues and disputes. Understanding these common mistakes is key to developing a fair and legal policy.

Over-specifying and Incurring Cost

A company's attempt to maximize safety by dictating highly specific features can inadvertently turn employee-provided footwear into employer-provided PPE. By defining the shoes as a solution to a specific hazard, they also define their financial responsibility for them.

Misinterpreting the "Non-Specialty" Exemption

The most common error is assuming that any safety-toe boot qualifies for the payment exemption. The analysis must always consider whether the employer's requirements make the footwear specialized for the unique hazards of their workplace.

Creating a De Facto Uniform

By requiring all employees to wear identical or highly similar footwear at all times, the company treats the shoes as part of a required uniform. When PPE doubles as a required uniform, the employer's obligation to pay is significantly strengthened.

Making the Right Choice for Your Policy

To determine financial responsibility in your own workplace, you must evaluate your requirements with objectivity.

- If your primary focus is compliance: Recognize that mandating specific features beyond a basic safety toe (like material, sole type, or high ASTM ratings) makes you responsible for payment.

- If your primary focus is cost management: Allow employees to choose any footwear that meets a general safety-toe standard, which strengthens your position to use the "non-specialty" payment exemption.

- If your primary focus is maximum safety: Specify the exact footwear needed for your workplace hazards, but budget for the cost, as it is clearly defined PPE that the employer must provide.

Ultimately, the more an employer's policy dictates the specific protective features of footwear, the clearer their obligation becomes to provide it at no cost to the employee.

Summary Table:

| Key Factor | Employer Payment Obligation |

|---|---|

| Requires specific ASTM standard (e.g., F2413-05) | High - Footwear is specialized PPE |

| Mandates specific materials (e.g., leather, oil-resistant soles) | High - Tied directly to workplace hazards |

| Only requires a basic safety toe, can be worn off-site | Low/None - May qualify for 'non-specialty' exemption |

| Footwear functions as a de facto uniform | High - Strengthens obligation to pay |

Need Help Sourcing Compliant Safety Footwear?

As a large-scale manufacturer, 3515 produces a comprehensive range of ASTM-compliant safety boots and shoes for distributors, brand owners, and bulk clients. We help you navigate complex OSHA requirements and provide the exact protective footwear your policy demands, ensuring both worker safety and your compliance.

Contact our experts today to discuss your specific needs and receive a customized quote.

Visual Guide

Related Products

- Wholesale Safety Footwear Manufacturer for Bulk & Custom OEM Orders

- Safety Footwear Wholesale Manufacturer for Custom OEM/ODM Production

- Premium Waterproof Nubuck Safety Boots for Wholesale

- Wholesale Customizable Safety Boots Durable & Protective Footwear Manufacturing

- Wholesale Durable Safety Boots Manufacturer Customizable Steel Toe Work Boots

People Also Ask

- Why do landscapers need steel-toe boots? Essential Protection for a Hazardous Job

- How do safety shoes contribute to cost savings for companies? A Strategic Investment in Risk and Cost Management

- Why is manufacturer diversity and inclusion important in work boot design? For Superior Fit, Safety & Comfort

- What features should warehouse workers look for in work boots? Prioritize Safety, Slip Resistance & All-Day Comfort

- What are the common types of safety boots and their primary uses? A Guide to Industrial Footwear