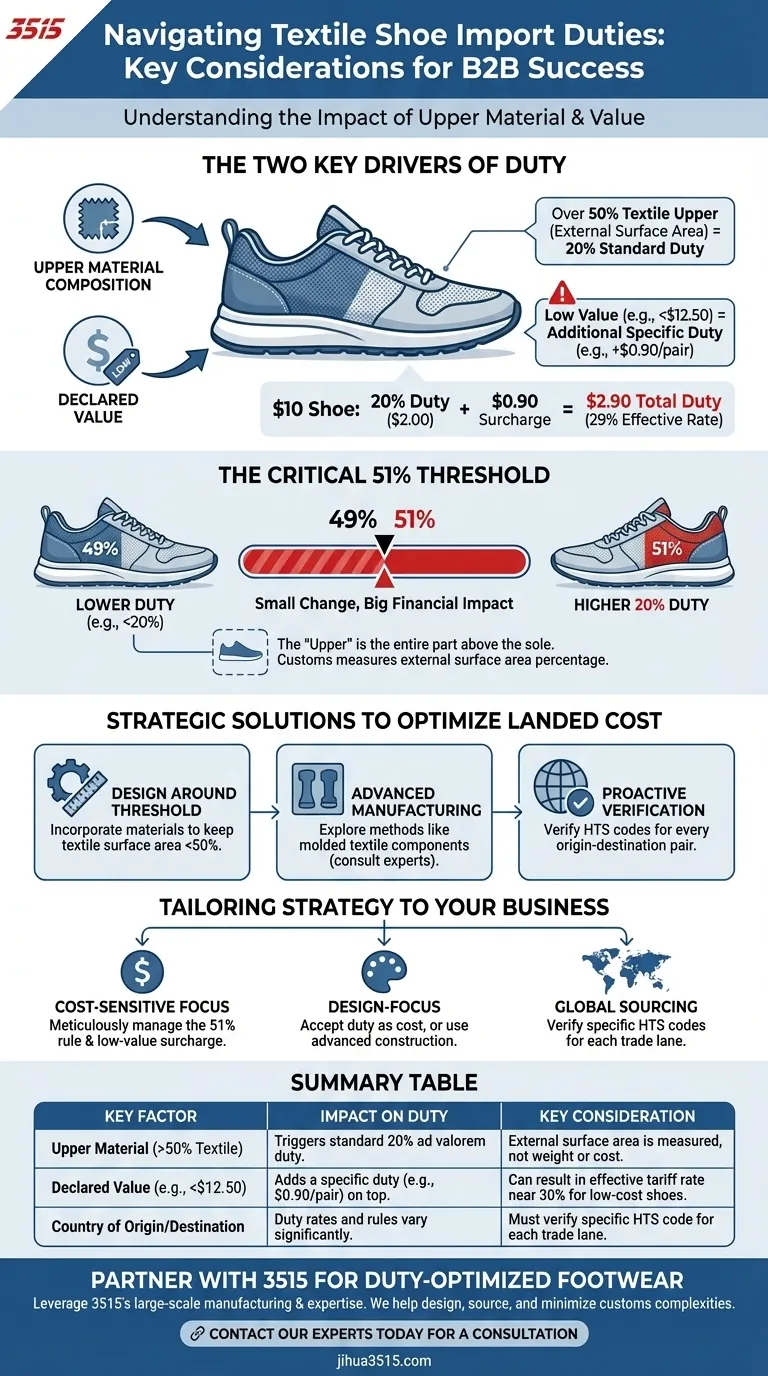

Understanding the import duty on textile shoes requires knowing two key variables: the material composition of the shoe's upper and its declared value. For shoes where the upper's external surface area is over 50% textile, a standard 20% import duty typically applies. Furthermore, if these shoes are valued below a certain threshold, such as US$12.50, an additional specific duty (e.g., $0.90 per pair) is often levied, significantly impacting the total cost.

The classification of your shoe's upper is the single most critical factor determining its import duty. A seemingly minor design choice that pushes the textile surface area past the 50% threshold can dramatically alter your final landed cost and profitability.

The Critical 51% Threshold Explained

Customs classification for footwear is notoriously complex, but for textile shoes, it often hinges on a simple majority rule applied to the shoe's upper.

Defining the "Upper"

The "upper" refers to the entire portion of the shoe that sits above the sole. Customs officials are concerned with the external surface area of this component—what you can see and touch.

How Surface Area is Calculated

This is a precise, geometric measurement. It is not based on the weight of the materials, their cost, or their feel. An official will assess what percentage of the upper's exterior is made of textile versus other materials like leather or plastic.

The Financial Impact of Classification

Crossing the 50% textile threshold is a significant event. A shoe with 49% textile might fall under a different classification with a much lower duty rate, while a nearly identical shoe with 51% textile immediately jumps to the higher 20% tariff.

Navigating Value-Based Duties

Beyond the material composition, the declared value of the shoe can trigger additional fees, especially for lower-cost footwear.

The Low-Value Surcharge

Many tariff schedules include a provision that adds a specific, fixed-dollar duty to shoes valued below a certain price point (e.g., US$12.50). This fee, such as $0.90 per pair, is applied in addition to the percentage-based duty.

The Impact on Margins

This dual-duty system disproportionately affects budget-friendly footwear. A $10 shoe could face a 20% duty ($2.00) plus the $0.90 surcharge, resulting in a total duty of $2.90. This equates to an effective tariff rate of 29%, far higher than the initial 20%.

Understanding the Trade-offs and Strategic Solutions

You are not powerless against these regulations. Strategic design and manufacturing choices can directly influence your final duty liability.

Designing Around the Threshold

The most direct strategy is to control the material composition. By incorporating leather or synthetic panels, designers can intentionally keep the textile surface area just under the 50% mark to avoid the higher tariff category.

Advanced Manufacturing Techniques

Some manufacturers use methods like molding textile components directly onto the sole. This can sometimes alter the shoe's classification, potentially leading to a lower duty rate. This is an advanced strategy that requires consultation with a customs expert.

The Critical Role of Verification

The figures cited (20%, $12.50, $0.90) are common examples but are not universal. Import duties vary dramatically based on the country of origin and the destination country. Trade agreements and tariff schedules are constantly changing.

The Cost of Misclassification

Guessing or making an error on your customs declaration can lead to severe penalties. These can include fines, shipment delays, seizure of your goods, and intensified scrutiny on all future imports. The risk of non-compliance is always higher than the cost of due diligence.

How to Apply This to Your Business

To effectively manage costs, your design and sourcing strategy must be aligned with these customs realities from the very beginning.

- If your primary focus is cost-sensitive, high-volume footwear: Pay meticulous attention to the 51% textile rule and the low-value surcharge, as these can disproportionately erode your margins.

- If your primary focus is design freedom with textile materials: Either accept the higher 20% duty as a cost of business and price your product accordingly, or engage a customs specialist to explore advanced construction methods.

- If you are sourcing from multiple countries or selling internationally: Never assume the duty rate is the same; you must verify the specific Harmonized Tariff Schedule (HTS) code for each origin-destination pair.

Ultimately, proactive material analysis and professional verification are the essential tools for navigating customs and protecting your profitability.

Summary Table:

| Key Factor | Impact on Duty | Key Consideration |

|---|---|---|

| Upper Material (>50% Textile) | Triggers standard 20% ad valorem duty. | The external surface area is measured, not weight or cost. |

| Declared Value (e.g., <$12.50) | Adds a specific duty (e.g., $0.90/pair) on top of the percentage. | Can result in an effective tariff rate of nearly 30% for low-cost shoes. |

| Country of Origin/Destination | Duty rates and rules vary significantly. | Must verify the specific HTS code for each trade lane. |

Protect Your Footwear Profitability with 3515

Navigating complex import duties requires a manufacturing partner with deep expertise. As a large-scale manufacturer, 3515 produces a comprehensive range of footwear for distributors, brand owners, and bulk clients. Our production capabilities encompass all types of shoes and boots, and we can provide strategic guidance on material selection and construction methods to help you optimize your landed costs.

Let us help you design and source footwear that meets your market needs while minimizing customs complexities. Contact our experts today for a consultation on your next order.

Visual Guide

Related Products

- Durable Canvas Work Shoes with Rubber Lug Sole | Wholesale Manufacturer

- Durable Rubber-Soled Utility Shoes for Wholesale & Custom Brand Manufacturing

- Wholesale Durable Camouflage Canvas Shoes with High-Traction Cleated Rubber Sole

- Wholesale Breathable Training Shoes Custom Athletic Footwear Manufacturer

- Wholesale Durable & Breathable Training Shoes for Custom Brands

People Also Ask

- Why is choosing the right work boot important? The Ultimate Guide to Industry-Specific Footwear Safety

- How does the drainage design of anti-slip footwear contribute to stability during zero-degree temperature transitions?

- Which sole materials are recommended for wet concrete floors? Choose the Safest Grip for Your Team

- What are the benefits of wearing the right work boots? Protect Your Feet and Enhance Job Performance

- What is the specific protective mechanism of safety shoes? Essential PPE Insights for Smelting Workshops