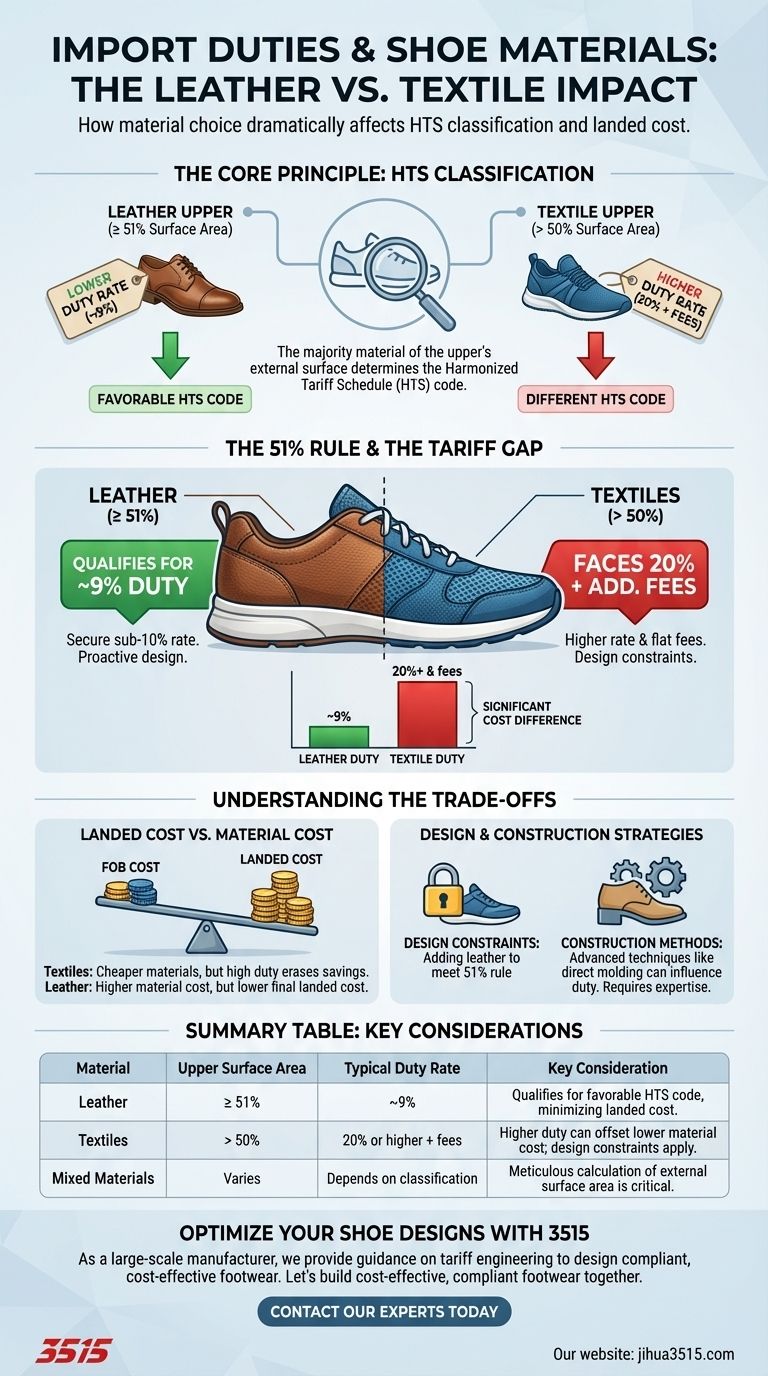

Yes, the material choice between leather and textiles dramatically affects a shoe's import duty. As a general rule, shoes with a leather upper are subject to a significantly lower duty rate than those with a textile upper. A shoe with an upper surface area that is at least 51% leather can have a duty rate around 9%, whereas a textile shoe can face duties of 20% or even higher, plus additional fees.

The core issue isn't simply the material itself, but how that material dictates the shoe's official customs classification. The Harmonized Tariff Schedule (HTS) has specific codes for footwear, and the primary determining factor for classification is the material comprising the majority of the upper's external surface area.

The Core Principle: How Material Defines Duty

The customs duty applied to a shoe is determined by its HTS code. For footwear, this code is heavily influenced by the material composition of the upper part of the shoe.

The 51% Rule for Leather

For a shoe to be classified as "leather" by customs, its upper must have an external surface area that is over 50% leather.

Meeting this 51% threshold is the critical factor that allows a shoe to qualify for the lower duty rate, which is often in the range of 9%.

The High Duty on Textiles

Shoes with uppers made predominantly of textile materials fall into a different HTS classification.

This category carries a much higher duty rate. It's often a combination of a base percentage (e.g., 20% of the FOB price) plus additional flat fees per pair, making them substantially more expensive to import.

Why This Tariff Gap Exists

This significant difference in duty rates is a result of long-standing trade policies.

Historically, these policies were often designed to protect domestic industries. Higher tariffs on certain categories of goods, like textile footwear, can make imported products less competitive against locally manufactured alternatives.

Understanding the Trade-offs

While choosing leather seems like an easy financial decision, it creates a series of design and production trade-offs that must be managed.

Landed Cost vs. Material Cost

While textiles are often cheaper raw materials than leather, the high import duty can easily erase that initial cost saving.

This means a textile shoe could have a lower factory price (FOB cost) but a higher final price after customs clearance (landed cost).

Design and Performance Constraints

The 51% rule can impose direct constraints on your design.

If a designer wants to create a lightweight, breathable athletic shoe using modern textiles, they may be forced to add leather panels purely to meet the tariff requirement, potentially compromising the shoe's performance or aesthetic.

Construction Methods as a Strategy

Advanced manufacturing techniques can sometimes influence classification.

For example, certain methods of molding a textile upper directly onto the rubber sole can, in some cases, place the shoe in a more favorable duty category. This is a complex area that requires expert consultation.

Making the Right Choice for Your Product

Navigating these regulations requires a proactive approach to design and sourcing, a practice often called "tariff engineering."

- If your primary focus is minimizing landed cost: Prioritize designs that definitively meet the 51% leather upper rule to secure the sub-10% duty rate.

- If your primary focus is performance using textiles: Accept the higher duty as a necessary cost, but engage a customs broker early to see if any construction methods can mitigate it.

- If you are developing a mixed-material shoe: Meticulously calculate the external surface area percentages of all materials on the upper before finalizing the design to ensure you land in your target classification.

Ultimately, understanding these tariff principles allows you to make intentional design and sourcing decisions that align with your product's financial goals.

Summary Table:

| Material | Upper Surface Area | Typical Duty Rate | Key Consideration |

|---|---|---|---|

| Leather | ≥ 51% | ~9% | Qualifies for favorable HTS code, minimizing landed cost. |

| Textiles | > 50% | 20% or higher + fees | Higher duty can offset lower material cost; design constraints apply. |

| Mixed Materials | Varies | Depends on classification | Meticulous calculation of external surface area is critical. |

Optimize your shoe designs for cost-effective importation with 3515.

As a large-scale manufacturer, we produce a comprehensive range of footwear for distributors, brand owners, and bulk clients. Our expertise extends beyond production to include guidance on tariff engineering—helping you design shoes that meet performance goals while navigating complex HTS classifications to control your landed cost.

Let's build cost-effective, compliant footwear together. Contact our experts today for a consultation.

Visual Guide

Related Products

- Wholesale Comfort Leather Business Shoes with Dial Lacing System

- Factory Direct Wholesale Leather Comfort Shoes with Dial Closure

- Wholesale Leather Business Casual Shoes with Dial Closure - Manufacturer of Comfort Dress Sneakers

- Wholesale Leather Apron Toe Derby Shoes Custom Factory Production

- Wholesale Breathable Perforated Leather Derby Dress Shoes for Custom Brands

People Also Ask

- How does the analysis of footwear quality and durability correlate with second-hand purchasing? Bridging the Gap

- What are the features of racing motorcycle boots? Uncompromising Protection for High-Speed Riding

- Why is the assessment of chemical usage records essential for footwear? Unlocking Eco-Friendly Production Secrets

- What types of footwear fall under regular shoes? A Guide to Conventional Footwear Design

- What are the characteristics and considerations of using manual tools in footwear production? Precision vs. Ergonomics

- How can one identify copperheads and rattlesnakes? A Guide to Spotting the Key Differences

- Why is the use of standardized PPE mandatory in welding? Ensuring Safety Through Essential Protective Barriers

- How can tall socks enhance the look of lace-up boots? Add Style, Color & Texture