The primary factors are the potential for significant cost savings on Workers' Compensation claims and the understanding that employee participation is dramatically higher when they are not solely responsible for the cost. A company's decision to pay for safety shoes is ultimately a financial calculation, weighing the direct expense of the footwear against the much larger, indirect costs of a workplace injury.

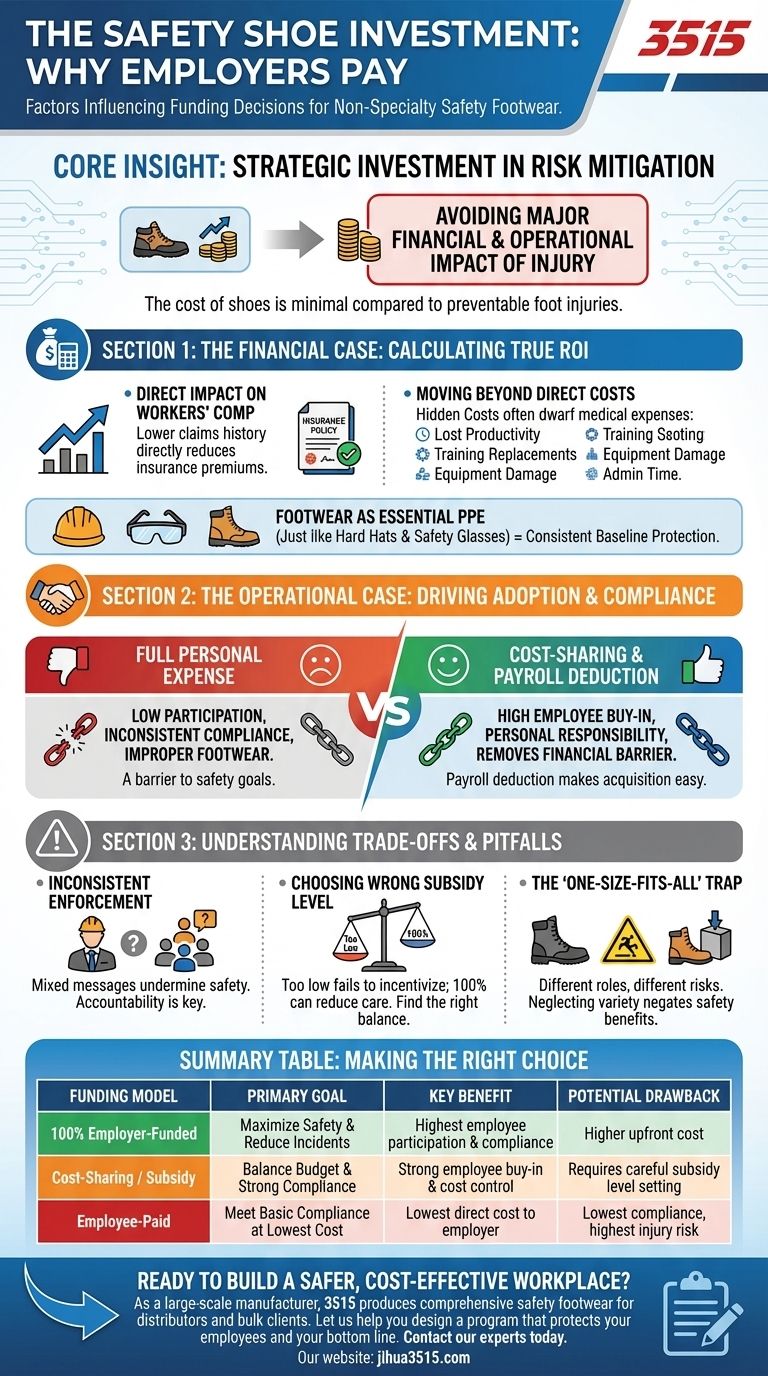

The decision to fund a safety shoe program is not about managing an expense; it is a strategic investment in risk mitigation. The core insight is that the cost of providing shoes is minimal compared to the financial and operational impact of a single preventable foot injury.

The Financial Case: Calculating the True ROI

The decision-making process begins with a clear-eyed assessment of the financial risks associated with foot injuries. This moves the conversation from a simple line-item expense to a strategic investment.

The Direct Impact on Workers' Compensation

Workers' Compensation premiums are directly tied to your company's injury and claims history.

A robust safety shoe program is one of the most effective ways to prevent common slips, falls, and impact injuries, which can directly lower your experience modification rate and reduce insurance costs.

Moving Beyond Direct Costs

The costs of an injury extend far beyond the insurance claim.

You must also account for lost productivity, the expense of training a replacement worker, potential equipment damage, and administrative time spent on incident reporting. These hidden costs often dwarf the initial medical expenses.

Footwear as a Preventative Tool

Think of company-provided safety shoes not as a perk, but as an essential piece of personal protective equipment (PPE).

Just as you would provide hard hats or safety glasses in required areas, providing footwear ensures a baseline level of protection is met consistently across your entire workforce.

The Operational Case: Driving Adoption and Compliance

A safety shoe policy is only effective if employees consistently follow it. The payment model you choose is the single biggest factor influencing employee participation and overall program success.

Why Full Personal Expense Fails

Requiring employees to bear the full cost often leads to low participation, inconsistent compliance, and the use of worn-out or improper footwear.

This model creates a barrier, undermining the very safety goals the policy is meant to achieve.

The Power of Cost-Sharing

A cost-sharing or subsidy model, where the employer pays a portion of the cost, is a highly effective middle ground.

It encourages employee buy-in and personal responsibility while removing the primary financial barrier to participation.

Payroll Deduction as a Low-Friction Option

Offering a payroll deduction option makes it even easier for employees to acquire proper footwear without a large, upfront out-of-pocket expense.

This simple administrative step significantly increases the likelihood that employees will purchase and wear the appropriate safety shoes.

Understanding the Trade-offs and Pitfalls

Implementing a safety shoe program requires careful consideration to avoid common mistakes that can limit its effectiveness and create new challenges.

The Risk of Inconsistent Enforcement

A policy that is not enforced universally and consistently sends a mixed message about the importance of safety.

If supervisors do not hold their teams accountable, even the best-funded program will fail to reduce injuries.

Choosing the Wrong Subsidy Level

If the company's contribution is too low, it may not be enough to incentivize participation.

Conversely, a 100% subsidy might lead some employees to be less careful with their equipment, potentially increasing replacement frequency. Finding the right balance is key.

The "One-Size-Fits-All" Program Trap

Different roles have different risks and require different types of footwear.

Failing to offer a selection of appropriate shoes can lead to employees wearing footwear that is not suitable for their specific tasks, negating the safety benefit.

Making the Right Choice for Your Goal

Your funding model should align directly with your organization's primary objective for the program.

- If your primary focus is maximizing safety and reducing incidents: A 100% employer-funded program or a significant subsidy is the most effective approach to ensure universal adoption.

- If your primary focus is balancing budget with strong compliance: A cost-sharing model combined with payroll deduction offers a powerful incentive for employees while controlling direct costs.

- If your primary focus is meeting basic compliance at the lowest initial cost: Requiring employees to purchase their own shoes is an option, but be prepared for lower compliance and a higher risk of preventable injuries.

Ultimately, investing in your team's safety is a direct investment in your company's operational stability and financial health.

Summary Table:

| Funding Model | Primary Goal | Key Benefit | Potential Drawback |

|---|---|---|---|

| 100% Employer-Funded | Maximize Safety & Reduce Incidents | Highest employee participation & compliance | Higher upfront cost |

| Cost-Sharing / Subsidy | Balance Budget & Strong Compliance | Strong employee buy-in & cost control | Requires careful subsidy level setting |

| Employee-Paid | Meet Basic Compliance at Lowest Cost | Lowest direct cost to employer | Lowest compliance, highest injury risk |

Ready to build a safer, more cost-effective workplace?

As a large-scale manufacturer, 3515 produces a comprehensive range of safety footwear for distributors, brand owners, and bulk clients. Our production capabilities encompass all types of safety shoes and boots designed to meet diverse workplace hazards.

Let us help you design a safety shoe program that protects your employees and your bottom line. Contact our experts today to discuss your needs and receive a tailored solution.

Visual Guide

Related Products

- Custom Safety Shoe Manufacturer for Wholesale & OEM Brands

- Premium KPU Athletic Safety Shoes for Wholesale

- Premium Lightweight Safety Shoes for Wholesale & Bulk Orders

- Wholesale Durable Breathable Safety Boots Custom OEM Manufacturer

- Wholesale Leather Safety Boots with Customizable Protective Toe

People Also Ask

- Why are sneaker-style work shoes popular? Unlock All-Day Comfort and Mobility

- How can material selection mitigate skin injuries caused by the physical pressure of protective equipment? Key Strategies

- How do safety shoes combine style and protection? Achieve a Professional Look Without Compromising Safety

- What materials are used for the outsoles of safety shoes? Choose the Right Protection for Your Job

- What materials should a good safety shoe include? The Ultimate Guide to Protective Footwear

- How does the implementation of standardized safety footwear impact OHS in plantations? Boost Safety & Output

- What does a white label with a green fir tree symbol on safety footwear mean? Essential Chainsaw Protection Explained

- What is the role of leather processing drums in preventing hexavalent chromium? Achieve Non-Toxic Safety Shoe Leather