Regional preferences for oil field boot brands are not arbitrary; they are driven by a logical blend of local climate, specific operational hazards, and a brand's established reputation. Brands that dominate a particular region often do so because their design philosophy—whether focused on rugged durability or technological innovation—is perfectly aligned with the demands of that environment.

The core reason for regional brand preference is that the work environment dictates the necessary tool. A boot's popularity in a specific area is a strong indicator of its suitability for the unique combination of climate, hazards, and work culture found there.

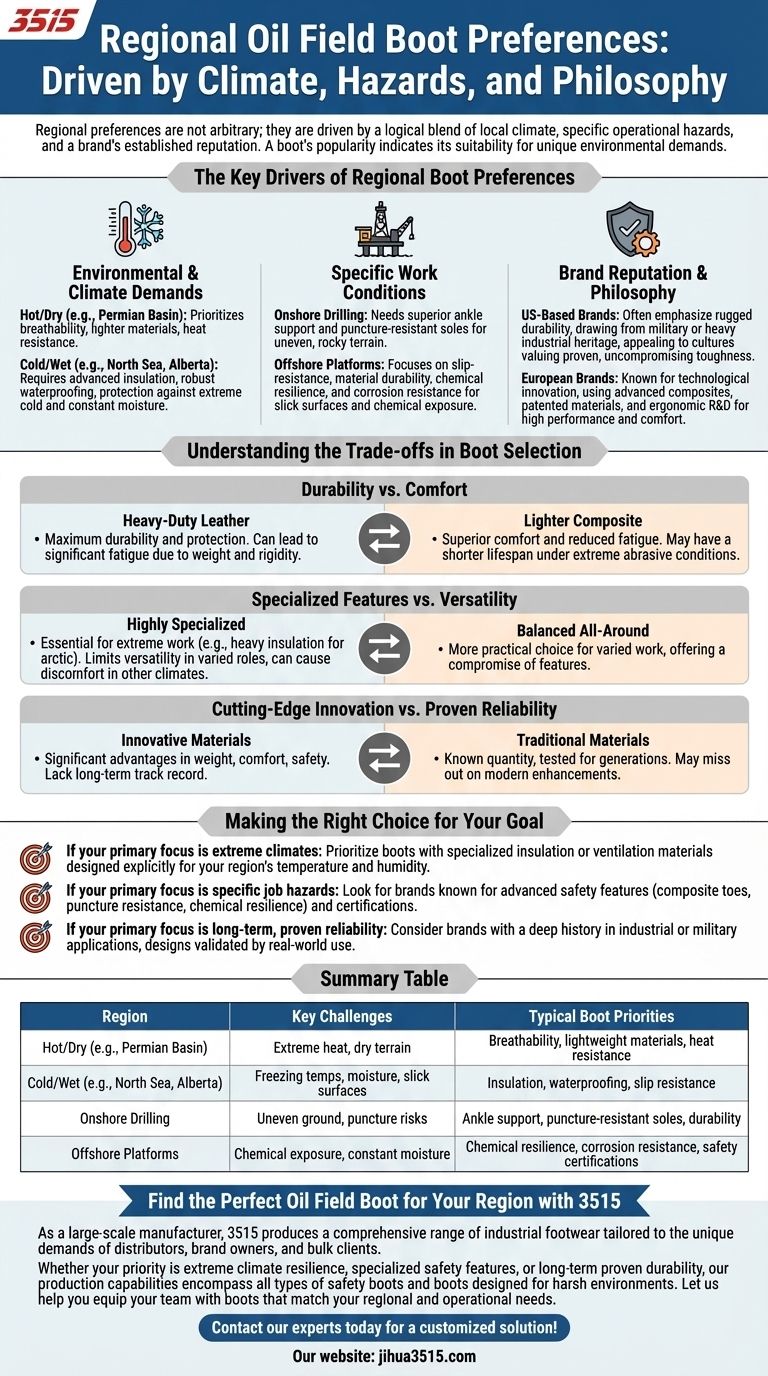

The Key Drivers of Regional Boot Preferences

Understanding why a certain brand is favored in Texas versus the North Sea requires looking beyond marketing and at the fundamental engineering and design choices that solve specific on-the-ground problems.

Environmental and Climate Demands

The most immediate factor is the local climate. A boot designed for the heat and dry conditions of the Permian Basin will prioritize breathability and lighter materials.

Conversely, boots popular in colder regions like Alberta or the North Sea will feature advanced insulation and robust waterproofing to protect against extreme cold and constant moisture.

Specific Work Conditions

The nature of the work itself shapes boot requirements. Onshore drilling might involve walking on uneven, rocky terrain, demanding boots with superior ankle support and puncture-resistant soles.

Offshore platforms, however, present challenges like slick, wet surfaces and exposure to corrosive chemicals, making slip-resistance and material durability the top priorities.

Brand Reputation and Philosophy

A brand's identity plays a significant role. Some US-based brands build their reputation on a legacy of ruggedness, often drawing from military or heavy industrial heritage. This appeals to a culture that values proven, uncompromising durability.

In contrast, some European brands are known for emphasizing technological innovation, using advanced composites, patented materials, and ergonomic R&D to deliver high performance and comfort.

Understanding the Trade-offs in Boot Selection

No single boot is perfect for every situation. The features that make a boot ideal for one environment often represent a compromise in another. This is the critical trade-off analysis that professionals must make.

Durability vs. Comfort

A classic, heavy-duty boot made with thick leather may offer maximum durability and protection. However, its weight and rigidity can lead to significant fatigue over a 12-hour shift.

Lighter, more modern boots using composite materials may offer superior comfort and reduce fatigue but might have a shorter operational lifespan under extreme abrasive conditions.

Specialized Features vs. Versatility

A boot with heavy insulation is essential for arctic work but becomes a liability in a temperate or hot climate, causing discomfort and potential health issues.

Choosing a highly specialized boot can limit your versatility if you move between different roles or environments. A more balanced, all-around boot might be a more practical choice for varied work.

Cutting-Edge Innovation vs. Proven Reliability

New, innovative materials can offer significant advantages in weight, comfort, and safety. However, they may not have the long-term track record of traditional materials that have been proven over decades of hard use.

A brand with a long history provides a known quantity. You know exactly how it will perform because it has been tested in the field for generations, but you might miss out on modern comfort and performance enhancements.

Making the Right Choice for Your Goal

To select the best boot, align its primary design strengths with your most critical operational needs.

- If your primary focus is extreme climates: Prioritize boots with specialized insulation or ventilation materials designed explicitly for your region's temperature and humidity.

- If your primary focus is specific job hazards: Look for brands known for advanced safety features and certifications relevant to your work, such as composite toes, puncture resistance, or chemical resilience.

- If your primary focus is long-term, proven reliability: Consider brands with a deep history in industrial or military applications, as their designs are validated by decades of real-world use.

By understanding the technical reasons behind regional preferences, you can make an informed decision based on your true needs, not just a brand name.

Summary Table:

| Region | Key Challenges | Typical Boot Priorities |

|---|---|---|

| Hot/Dry (e.g., Permian Basin) | Extreme heat, dry terrain | Breathability, lightweight materials, heat resistance |

| Cold/Wet (e.g., North Sea, Alberta) | Freezing temps, moisture, slick surfaces | Insulation, waterproofing, slip resistance |

| Onshore Drilling | Uneven ground, puncture risks | Ankle support, puncture-resistant soles, durability |

| Offshore Platforms | Chemical exposure, constant moisture | Chemical resilience, corrosion resistance, safety certifications |

Find the Perfect Oil Field Boot for Your Region with 3515

As a large-scale manufacturer, 3515 produces a comprehensive range of industrial footwear tailored to the unique demands of distributors, brand owners, and bulk clients. Whether your priority is extreme climate resilience, specialized safety features, or long-term proven durability, our production capabilities encompass all types of safety boots and boots designed for harsh environments.

Let us help you equip your team with boots that match your regional and operational needs. Contact our experts today for a customized solution!

Visual Guide

Related Products

- Safety Footwear Wholesale Manufacturer for Custom OEM/ODM Production

- Premium Flame-Retardant Waterproof Safety Boots and Shoes

- Wholesale Safety Footwear Manufacturer for Bulk & Custom OEM Orders

- High Performance Fire-Retardant Waterproof Safety Boots

- Heavy-Duty Waterproof Nubuck Safety Boots Safety Shoes for Bulk Supply

People Also Ask

- Why are heavy duty work boots important in high-risk environments? Essential PPE for Ultimate Safety

- Why is hydrophobic waterproof leather commonly utilized in the construction of fire safety boots? Essential Protection

- Why is lightweight polyurethane (EVA) used for medical and work outsoles? Enhance Comfort & Safety in Every Step

- Why are moc toe boots popular among workers? Unmatched Comfort & Durability for Trades

- Why is it important for women to wear work boots in the construction industry? Essential Safety & Performance

- What health problems can result from wearing ill-fitting work boots? Protect Your Body from Foot to Back

- Why is checking and cleaning the tread of work boots important? Ensure Safety and Extend Boot Life

- What are some popular series of moc toe boots? Top Choices for Work & Style